We have access to ALL insurance providers in the UK.

1 in 2 people will develop some form of cancer during their lifetime.

Source NHS and Cancer Research

Types Of Insurance.

Level Term Life Insurance

Explained by Martin Lewis

1. Level Term Insurance

Is designed to payout a lump sum if you pass away OR are diagnosed to be Terminally Ill within a time frame or age.

(This means a doctor has signed you off as having only 12 months left to live.)

Level Term Insurance is used to cover large debts and leave money behind for loved ones. Most common and one of the cheapest forms of Life Insurance on the market.

2. Decreasing Term Life Insurance Or *Mortgage Insurance

Is designed to pay off your mortgage or cover Inheritance Tax in the event of death or Terminal Illness.

This policy will track and go down in value, in line with your mortgage. If you die the policy will payout the value of the mortgage and won’t leave anything else behind.

This policy is the cheapest on the market

3. Critical Illness Insurance

Is designed to payout a lump sum if you are diagnosed with a Critical Illness that is listed on the policy documents.

This policy is designed to protect or cover your income.

BUT you can have a Critical Illness Policy that decreases inline with your mortgage and will pay off your mortgage IF you are diagnosed with something Critical such as

Cancer, Heart Attack, Strokes, Loss of Limb etc etc.

Income Protection

Explained by me.

4. Income Protection

Is designed to payout a monthly amount until you can go back to work. This is so you don’t have to rely on Statutory sick pay which is £109.40 per week.

Income Protection will payout for ANY reason as long as a doctor has stated you can’t work and it has been documented.

- Broken Legs

- Illnesses

- Mental Health

Anything….

5. Other Ad Ons

With Life Insurance you can get extra add ons such as;

- Global Treatment ( Best Benefit Around )

- Fracture and Ligament Cover

- GP24/7 ( See a GP anywhere anytime )

6. “That’s alot of Options, I don’t know what I need?”

Has Your Head Fallen Off Yet?

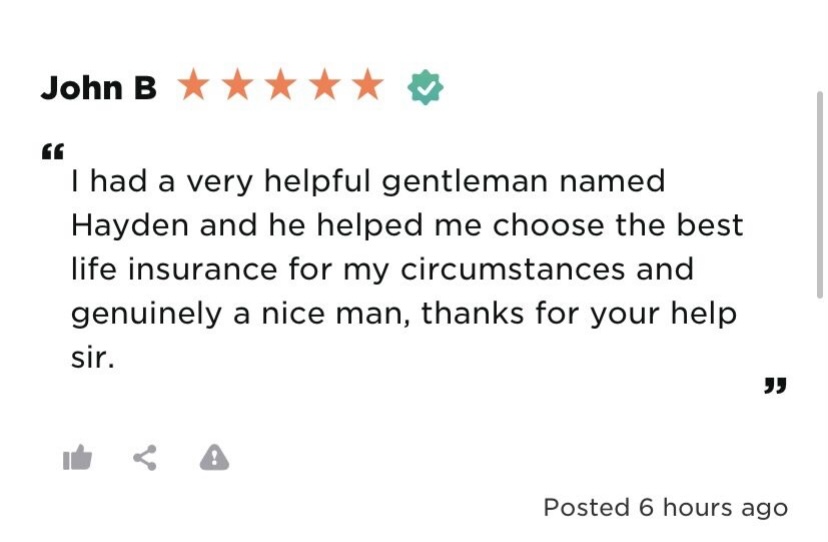

It’s alot of information. BUT don’t panic. This is my job, I am here to help 🙂

I will have a quick chat or ask for some information via email

(Whatever you are more comfortable with) then I will provide you with quotes and recommendations based on your circumstances as your circumstances will be very different to another person.

I’ve helped 1000’s of clients protect their families.

I’d love to protect yours as well.

Take Out A Policy = Getting Paid

Once you take out a policy.

We will provide you with Vouchers for Dreams 2 Reality.

HomeBuyer Helper

We help you buy houses.

Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on a mortgage or any other debt secured on it. The guidance and/or advice contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.

The guidance and/or information contained within this website is subject to United Kingdom (UK) regulatory regime and is therefore restricted to clients based in the UK. All advisors working with us are fully qualified to provide mortgage advice and work only for firms who are authorised and regulated by the Financial Conduct Authority. They will offer any advice specific to you and your needs.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR PROPERTY. YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Get updated

“We Help You Buy Your Home”